Yantai Changyu Pioneer Wine Co. Ltd. 2017 Annual Report Abstract

Shares Code: 000869, 200869 Shares Abbreviation: Changyu A, Changyu B Notice No.: 2018-Final01

Yantai Changyu Pioneer Wine Co. Ltd. 2017 Annual Report Abstract

1. Important Warning

This Annual Report abstract comes from the whole contents of annual report. If investors desire to comprehend the Company’s operating results, financial situation and future development plan, please read the Annual Report on the media specified by the China Securities Regulatory Commission.

Objections statement of directors, supervisors & senior managers

|

Name |

Position |

Content and reason |

Statement

Except the following directors, all other directors have personally attended the meeting for deliberating the annual report.

|

Director name with non-present in person |

Director post with non-present in person |

Reason for non-present in person |

Name of mandatory |

|

Sun Liqiang |

Director |

Business trip |

Zhou Hongjiang |

|

Antonio Appignani |

Director |

Business trip |

Augusto Reina |

|

Wang Shigang |

Independent director |

Business trip |

Wang Zhuquan |

Non-standard audit opinion notice

□Available RNot available

The preliminary scheme of the report period’s common stock profit distribution or increasing equity with reserve deliberated by the board of the directors

RAvailable □Not available

Whether to increase equity with reserve

□Yes RNo

The Company’s preliminary scheme of common stock profit distribution deliberated and passed by the board of the directors is as following: Based on the Company total 685,464,000 shares,we plan to pay CNY 5 in cash as dividends for every 10 shares (including tax) to the Company’s all shareholders, send 0 bonus(including tax) and capital reserve will not be transferred to equity.

The preliminary scheme of this report period’s preferred share profit distribution deliberated and passed by the board

□Available RNot available

2. Brief Introduction of the Company

(1) Company introduction

|

Abbreviation of the Shares: |

Changyu A, Changyu B |

Code number of the Shares |

000869, 200869 |

|

|

Place of listing of the Shares |

Shenzhen Stock Exchange |

|||

|

Abbreviation of the Shares after alteration (if have) |

- |

|||

|

Contact person and information |

Secretary to the Board of Directors |

Authorized Representative of the Securities Affairs |

||

|

Name |

Mr. Qu Weimin |

Mr. Li Tingguo |

||

|

Address |

56 Dama Road, Yantai, Shandong, China |

56 Dama Road, Yantai, Shandong, China |

||

|

Fax |

0086-535-6633639 |

0086-535-6633639 |

||

|

Tel |

0086-535-6633656 |

0086-535-6633656 |

||

|

|

quwm@changyu.com.cn |

stock@changyu.com.cn |

||

(2) Main businesses during the report period or product brief introduction

During the report period, the Company’s main business is to produce and operate wine and brandy, thus providing the domestic and foreign consumers with healthy and fashionable alcoholic drinks. Compared with earlier stage, there are no significant changes happened to the Company’s main businesses. The wine industry that the Company involved in is still in the growth stage, the whole domestic wine market is on the rising trend. The Company takes the dominant position in the domestic wine market.

(3) Key accounting data and financial indicators

①Key accounting data and financial indicators in recent three years

Whether the Company makes retroactive adjustments or restates the accounting data of previous fiscal years because of changes of accounting policy and/or accounting errors.

□Yes RNo

Unit: CNY

|

Item |

2017 |

2016 |

More or less than Last year (%) |

2015 |

|

Business revenue |

4,932,545,229 |

4,717,596,472 |

4.56% |

4,649,722,368 |

|

Net profit attributed to the shareholders of the listed company |

1,031,695,056 |

982,460,488 |

5.01% |

1,030,073,860 |

|

Net profit attributed to the shareholders of the listed company after deducting the irregular profit and loss |

986,095,872 |

941,730,478 |

4.71% |

993,268,823 |

|

Net cash flows from the operating activities |

973,243,027 |

889,911,970 |

9.36% |

1,143,046,367 |

|

Basic earnings per share (CNY/share) |

1.51 |

1.43 |

5.59% |

1.5 |

|

Diluted earnings per share (CNY/share) |

1.51 |

1.43 |

5.59% |

1.5 |

|

Weighted average for earning rate of the net assets |

12.14% |

12.55% |

-0.41% |

14.40% |

|

|

Dec. 31st 2017 |

Dec. 31st 2016 |

More or less than Last year (%) |

Dec. 31st 2015 |

|

Total assets |

12,536,755,208 |

11,528,077,971 |

8.75% |

10,344,211,461 |

|

Net Assets attributed to the shareholders of the listed company |

8,906,342,299 |

8,209,010,989 |

8.49% |

7,564,099,003 |

②Key financial indicators by quarter

Unit: CNY

|

|

1st Quarter |

2nd Quarter |

3rd Quarter |

4th Quarter |

|

Business revenue |

1,896,586,469 |

870,511,728 |

1,030,899,920 |

1,134,547,112 |

|

Net profit attributed to the shareholders of the listed company |

516,634,494 |

153,434,560 |

146,115,408 |

215,510,594 |

|

Net profit attributed to the shareholders of the listed company after deducting the irregular profit and loss |

512,684,945 |

140,221,430 |

138,825,432 |

|

|

Net cash flows from the operating activities |

384,358,508 |

36,001,811 |

386,267,511 |

166,615,197 |

Whether there are differences between the above mentioned financial indicators or their sum and the related financial indicators in the quarterly reports and semi-annual reports disclosed by the Company.

□Yes RNo

(4) Capital stock and shareholders’ situation

① Number of common stockholder and preferred shareholder recovering voting power, and situation of shares held by top ten shareholders

Unit: share

|

Total shareholders in the report period |

48,966 |

Total number of common shareholders by the end of last month before the disclosure day of the annual report |

44,606 |

Total number of preferred shareholder recovering voting power by the end of report period |

0 |

Total number of preferred shareholder recovering voting power by the end of last month before the disclosure day of the annual report |

0 |

|||

|

The top 10 shareholders holding situation |

||||||||||

|

Name of Shareholders |

Character of shareholders |

Percentage (%) |

Shares held until the end of the report period |

Number of restricted shares |

Pledged or frozen |

|||||

|

Share status |

Amount |

|||||||||

|

YANTAI CHANGYU GROUP CO. LTD. |

Domestic non-state-owned legal person |

50.40% |

345,473,856 |

345,473,856 |

-- |

0 |

||||

|

GAOLING FUND,L.P. |

Foreign legal person |

3.08% |

21,090,219 |

21,090,219 |

-- |

0 |

||||

|

2.32% |

15,924,155 |

15,924,155 |

-- |

0 |

||||||

|

BBH BOS S/A FIDELITY FD - CHINA FOCUS FD |

Foreign legal person |

2.22% |

15,241,826 |

15,241,826 |

-- |

0 |

||||

|

GUOTAI JUNAN SECURITIES(HONGKONG) LIMITED |

Foreign legal person |

1.00% |

6,881,493 |

6,881,493 |

-- |

0 |

||||

|

FIDELITY PURITAN TRUST: FIDELITY SERIES INTRINSIC OPPORTUNITIES FUND |

Foreign legal person |

0.89% |

6,100,762 |

6,100,762 |

-- |

0 |

||||

|

CENTRAL HUIJIN ASSET MANAGEMENT LTD. |

State-owned legal person |

0.69% |

4,761,200 |

4,761,200 |

-- |

0 |

||||

|

VANGUARD EMERGING MARKETS STOCK INDEX FUND |

Foreign legal person |

0.55% |

3,788,487 |

3,788,487 |

-- |

0 |

||||

|

FIDELITY CHINA SPECIAL SITUATIONS PLC |

Foreign legal person |

0.55% |

3,779,202 |

3,779,202 |

-- |

0 |

||||

|

NORGES BANK |

Foreign legal person |

0.52% |

3,558,797 |

3,558,797 |

-- |

0 |

||||

|

The explanation for the associated relationship and accordant action |

Among the top 10 shareholders, Yantai Changyu Group Company Limited has no associated relationship or accordant action relationship with the other 9 listed shareholders, and the relationship among the other shareholders is unknown. |

|||||||||

|

Explanation for shareholders who involved in financing activities and stock trading business (if any) |

The top 10 shareholders do not involve in financing activities and stock trade business. |

|||||||||

②Number of preferred shareholder and situation of preferred shares held by top ten preferred shareholders

□Available RNot available

There are no shares held by preferred shareholders during the report period.

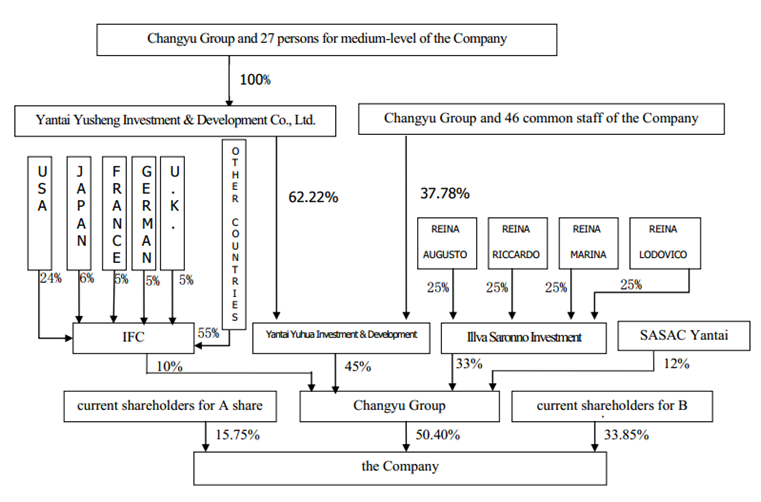

③Introduction for property right and control relations between the Company and its actual controllers

|

|

|

Yantai Guofeng Investment Holdings Co., Ltd |

(5) Company Bonds

Whether the Company exists public offering and lists on the Stock Exchange, and the Company is unable to fully pay company bonds in the approved announcement date of this annual report before maturity or in the maturity date.

No.

3. Management Discussion and Analysis

(1) Brief introduction of operation situation during the report period

Whether the Company need to follow the disclosure requirement of special business?

No.

①Summary

In 2017, influenced by the slowdown of domestic economic growth, the overall domestic wine industry was relatively stable and the demand in wine maintained the growth momentum with small amplitude, but the impact from imported wine became ever more severe and entire domestic wine brands were weak; owing to significant decrease in production of international and domestic wine-making grapes, the price of bulk wine increased by a large margin; based on environmental protection and governance factors, the cost of packing materials continued increasing; with the investment projects’ gradually putting into operation, the depreciation of fixed assets increased. Above-mentioned adverse factors brought bigger challenges for the Company to achieve sustained and steady growth. Facing quite a lot of external disadvantages, the Company insisted in taking the market as the center, insisted the development strategy of “Focus on middle-and-high level, Focus on high quality, Focus on big product”, comprehensively implemented the development strategy of same importance between wine and brandy, optimized product structure and market layout, accelerated the development of new product and did best to promote product sales, achieving good results and realizing business income of CNY4932.55million with an increase of 4.56% compared with last year and net profit of CNY1031.69 million belonging to the parent company’s shareholders with an increase of 5.01% compared with last year.

②Analysis of main business

|

Description |

Increase or decrease of the end of the period over the end of last year |

Cause of significant changes |

|

Operating revenue |

4.56% |

Mainly because of increase in sales volume |

|

Operating cost |

6.08% |

Mainly because of increase in sales volume |

|

Sales expense |

1.54% |

Mainly because of year-on-year increase in wage & welfare, advertising promotion fee in 2017 |

|

Management expense |

10.01% |

Mainly because of year-on-year increase in depreciation cost and office expense in 2017 |

|

R&D investment |

0.34% |

Mainly because of increase in expenses for technology research and development in 2017 |

|

Financial expense |

-15.38% |

Mainly because of decrease in loan interest expenditure |

|

Net amount of cash flow generated in operating activities |

9.36% |

Mainly because of increase in received cash from product sales and rendering of service |

|

Net amount of cash flow generated in investment activities |

-19.31% |

Mainly because of increase in fixed term deposit at least three months and cash used to acquire overseas enterprise |

|

Net amount of cash flow generated in capital-raising activities |

-494.03% |

Mainly because of decrease in received cash from loan, pledge loan security deposit and interest |

Review and summary of the process of the Company’s early-disclosed development strategy and business plan during the report period

During the report period, the Company realizes the business income of CNY4.93255billion with an increase of 4.56% compared with last year, exceeding the target fixed at the beginning of the year of realizing business income no less than CNY4.9billion. Facing to the unfavorable business environment, the Company insists the development trend of “Focus on middle and high level, Focus on high quality, Focus on big product”, fully implement the development strategy of same importance between wine and brandy, pushes hard on harmonious development of multi-liquor, which played an important part in realizing the increase in the business income.

The main work during the report period is shown as followed:

Firstly, the Company further integrated and perfected marketing system, accelerated new products’ launch in market, energetically developed E-business and export business and strengthened the management in market, achieving good results. During the report period, the Company optimized and integrated middle-and-low channel and B-category supermarket semi-direct supply company as well as distributors selling Castel, Noble Dragon or other main products, pushed out new products, such as 9th-generation Noble Dragon, new Zuishixian, Reserve five-star brandy and Cabernet Sauvignon dry white wine and so on, strived to expand E-business and export business and intensified the punishment to fleeing goods, effectively protecting distributors’ interest and realizing various degrees of increase in brandy, imported wine and other liquor as well as online sales and export business.

Secondly, the research for new products and new technologies was continued being conducted and the quality management was strengthened in order to improve technological level and product quality. The Company carried out 44 technology research, obtained 3 scientific and technological achievements at ministerial and provincial level, newly applied and obtained authorization of 8 national patent. The Company undertook three projects about Yantai scientific and technological development plan, including “Selection Research and Development Application of New Strain about Premium and Characteristic Grape Variety Cabernet Gernischt in Yantai Producing Region”, which passed result authentication and acceptance of China National Light Industry Council and Yantai Science and Technology Bureau and reached international advanced level. “Establishment and Application of Quality Evaluation and Control System about Premium Wine-making Grape Material and Wine” won first prize of China General Chamber of Commerce scientific and technological progress. The Company perfected quality control system, strengthened supervision, inspection and punishment degree, reinforced monitoring in key quality safety indicators, making product quality steadily improve. 2015 Golden-label Icewine of Changyu Golden Icewine Valley won special gold medal in 2017 IWSC. 2014 Merlot dry red wine of Xinjiang Changyu Balboa Family won gold medal in 2017 Decanter Asia Wine Awards.

Thirdly, informatization construction was steadily promoted and the market service ability of production system had a bigger improvement. The Company completed the construction of projects, such as first-phase ERP informatization of SAP and order production system of chateau wine and so on; fully implement the order production mode of chateau wine, shortened production cycle, reduced fund occupation and intensified management in the logistics link of chateau wine, effectively preventing the overstock of products; further standardized submission procedure of production and sales plan, assuring the timely grasp in the implementation situation of order and improving the level of market service ability of production system.

Fourthly, the procurement of raw materials, such as grapes, was completed successfully and the management in grape base was further strengthened. The Company comprehensively accomplished the procurement plan of raw material, such as grapes, and further deepened sort management and sort acquisition in grape base, making scientific and normative management in grape base reach a higher level; perfected grape purchase policy, improving the stable development of grape base; improved grape purchase standard and promoted raw material quality; actively introduced new grape variety, conducted selection and improvement work, cultivated a lot of new varieties, enriching the variety resource for future product development; took series of technology research and promotion work on how to improve raw material quality in self-supporting base and organized orchardist to take professional training on grape planting technology for many times, improving their level of grape planting and management.

Fifthly, the Company continued promoting internationalization strategy and steadily implemented overseas acquisition. This company, together with LAMBO SpA, establishes a joint venture enterprise Indomita Wine Company Chile, SpA (Chinese name: 智利魔狮葡萄酒简式股份公司, for short “Indomita Wine”). After establishment, as transferee, Indomita Wine acquires 100% equity of all three subsidiaries under Chile Bethwines. In addition, the Company reached the agreement in acquiring 80% equity of Kilikanoon Estate Pty Ltd in Australia with transferor.

③Revenue, sales and cost

1) Composition of operating incomes

Unit: CNY

|

` |

2017 |

2016 |

Year-on-year increase or decrease (%) |

||

|

Amount |

Proportion in operating incomes |

Amount |

Proportion in operating incomes |

||

|

Total operation revenue |

4,932,545,229 |

100% |

4,717,596,472 |

100% |

4.56% |

|

Industry-classified |

|||||

|

Industry of liquor and alcoholic beverage |

4,932,545,229 |

100% |

4,717,596,472 |

100% |

4.56% |

|

Product-classified |

|||||

|

Wine |

3,829,326,556 |

77.63% |

3,700,806,317 |

78.45% |

3.47% |

|

Brandy |

989,889,728 |

20.07% |

905,687,936 |

19.20% |

9.30% |

|

Others |

113,328,945 |

2.30% |

111,102,219 |

2.36% |

2.00% |

|

Area-classified |

|||||

|

Domestic |

4,497,288,066 |

91.18% |

4,437,302,746 |

94.06% |

1.35% |

|

Abroad |

435,257,163 |

8.82% |

280,293,726 |

5.94% |

55.86% |

2) Sales

|

Sector |

Project |

Unit |

2017 |

2016 |

Year-on-year increase or decrease (%) |

|

Wine |

Sales volume |

Ton |

104,016 |

98,958 |

5.11% |

|

Production |

Ton |

97,620 |

99,784 |

-2.17% |

|

|

Brandy |

Sales volume |

Ton |

39,130 |

40,171 |

-2.59% |

|

Production |

Ton |

37,666 |

43,262 |

-12.93% |

3) Composition of operating costs

Unit: CNY

|

Sector |

Project |

2017 |

2016 |

Year-on-year increase or decrease (%) |

||

|

Amount |

Proportion in the operating cost (%) |

Amount |

Proportion in the operating cost (%) |

|||

|

Wine |

Blending liquor |

711,224,945 |

56.16% |

692,570,791 |

57.49% |

-1.32% |

|

Packing material |

395,026,889 |

31.19% |

372,613,924 |

30.93% |

0.27% |

|

|

Wages |

47,843,744 |

3.78% |

44,895,195 |

3.73% |

0.05% |

|

|

manufacturing cost |

112,295,874 |

8.87% |

94,704,442 |

7.86% |

1.01% |

|

|

Brandy |

Blending liquor |

204,764,927 |

58.12% |

187,495,081 |

58.99% |

-0.87% |

|

Packing material |

117,982,142 |

33.49% |

105,943,197 |

33.33% |

0.15% |

|

|

Wages |

9,678,688 |

2.75% |

11,965,588 |

3.76% |

-1.02% |

|

|

manufacturing cost |

19,903,211 |

5.65% |

12,441,839 |

3.91% |

1.73% |

|

④Costs

Unit: CNY

|

|

2017 |

2016 |

Year-on-year increase or decrease (%) |

Explanation of significant changes |

|

Sales expense |

1,272,522,443 |

1,253,260,668 |

1.54% |

Mainly because of year-on-year increase in wage & welfare, advertising promotion fee in 2017 |

|

Management expense |

340,781,958 |

309,783,548 |

10.01% |

Mainly because of year-on-year increase in depreciation cost and office expense in 2017 |

|

Financial expense |

18,590,259 |

21,968,859 |

-15.38% |

Mainly because of decrease in loan interest expenditure |

⑤Cash flow

Unit: CNY

|

Item |

2017 |

2016 |

Year-on-year increase or decrease (%) |

|

Subtotal of cash inflow in operating activities |

4,965,586,341 |

4,525,609,466 |

9.72% |

|

Subtotal of cash outflow in operating activities |

3,992,343,314 |

3,635,697,496 |

9.81% |

|

Net amount of cash flow generated in operating activities |

973,243,027 |

889,911,970 |

9.36% |

|

Subtotal of cash inflow in investment activities |

216,678,355 |

112,952,925 |

91.83% |

|

Subtotal of cash outflow in investment activities |

1,036,886,116 |

800,394,471 |

29.55% |

|

Net amount of cash flow generated in investment activities |

-820,207,761 |

-687,441,546 |

-19.31% |

|

Subtotal of cash inflow in capital-raising activities |

1,064,892,130 |

1,191,567,445 |

-10.63% |

|

Subtotal of cash outflow in capital-raising activities |

1,307,993,557 |

1,232,491,837 |

6.13% |

|

Net amount of cash flow generated in capital-raising activities |

-243,101,427 |

-40,924,392 |

-494.03% |

|

Net increase of cash and cash equivalents |

-76,053,030 |

164,700,643 |

-146.18% |

⑥Assets and liabilities situation

Unit: CNY

|

|

At the end of 2017 |

At the end of 2016 |

Proportion increase or decrease (%) |

Explanation on major changes |

||

|

Amount |

Proportion in the total assets (%) |

Amount |

Proportion in the total assets (%) |

|||

|

Monetary funds |

1,402,522,509 |

11.19% |

1,391,517,607 |

12.07% |

-0.88% |

- |

|

Receivables |

263,796,355 |

2.1% |

173,062,628 |

1.50% |

0.6% |

- |

|

Inventory |

2,473,614,046 |

19.73% |

2,248,609,740 |

19.51% |

0.22% |

- |

|

Investment real estate |

18,467,989 |

0.15% |

|

0% |

0.15% |

- |

|

Long-term equity investments |

0 |

0% |

|

0% |

0% |

- |

|

Fixed assets |

5,329,083,969 |

42.51% |

4,683,187,493 |

40.62% |

1.89% |

Mainly because parts of construction projects have been transferred to fixed asset |

|

Construction in progress |

1,026,141,569 |

8.19% |

1,346,281,737 |

11.68% |

-3.49% |

Mainly because parts of construction projects have been transferred to fixed asset |

|

Short-term borrowings |

714,434,286 |

5.70% |

662,388,882 |

5.75% |

-0.05% |

- |

|

Long-term borrowings |

156,125,854 |

1.25% |

49,140,555 |

0.43% |

0.82% |

- |

⑦Expectation for the Company’s future development

On the basis of our limited experience and special skills, we make the following estimation of the wine sector and the Company’s future development:

1) The sector competition setup and development trend

Under the slowdown effect of national macroscopic economy growth, the operation situation of the Company will become more severe, plus the change of the alcohol consumption environment, leading to difficulties in selling high-end products; Consumers tend to be more rational, which requires Changyu to make more efforts in improving the cost performance of products; Owing that influx of plenty of imported wines would further compress the domestic wine market shares and the new channels such as E-commerce cause great impact on the traditional sales channels, the competition in the domestic wine industry will still be fierce at present and in the future long time; Raw material cost, freight and depreciation expense and other expenses are likely to increase, bringing big pressure to the Company’s profitability. But in the long run, thanks to increase in their income, more and more people would pursue health and fashion life mode and the people would be in more favor of wines which fit quite well with the trend of consumption, ceaselessly stimulating the demands for premium wine. This decides that the Chinese wine industry owns a huge market development potential, especially that brandy and wine with high price ratio might have a faster growth. In addition, with the increased consumption by domestic middle class, “drink less, drink good, drink healthily” will become future tendency and wine will keep continuous and rapid development trend in China. In such a case of long-term coexistence of opportunities and challenges, those enterprises that possess strong brand influence and marketing ability, catch the opportunities, actively take adjustments, make full use of newly emerging and traditional sales channels, timely satisfy the consumers’ demands and provide products with high price ratio will have the opportunity to be the final winner of competition and then form a new structure of the future Chinese wine market.

2) The Company’s development strategy

The Company will insist the development direction of “Focus on middle-and-high level, Focus on high quality, Focus on big product”, comprehensively implement the development strategy of same importance between wine and brandy, endeavour to promote the harmonious development of various liquor; actively expand the scope of consumption field and marketing mode, industriously develop middle-and--high-end wines and brandy, strengthen the marketing level of imported wine and strive to provide consumers with a rich variety of products in high price ratio.

3) Management plan in new year

In 2018, the Company will try its best to realize business income of not less than CNY5.2 billion and control the main operating costs and three period expenses below CNY3.7 billion.

4) The measures the Company will take

In order to better catch the opportunities and face the challenges, the Company will take full advantage of self-owned advantages, adhere to market-orientation, intensify internal adjustment and reformation degree, enlarge subsidiaries’ autonomous right in operation, increase enterprise vitality, implement the performance assessment mode of mainly focusing on profit, pay attention to following aspects in 2018 in order to achieve the annual operation target:

Firstly, the Company will insist the development direction of focusing on middle-and-high-level products, focusing on high quality and focusing on big product. Based on product Characteristics, the Company will further clear brand positioning of wine, brandy and imported liquor and insist in focusing on the strategy of developing middle-and-high-level products. The Company will further perfect quality management traceability system and actively promote the construction of product quality traceability informatization system; build raw material base in premium wine-making grape region including France, Chile and Australia and so on in order to improve the scientific management level of domestic base and to assure the stable supply of premium bulk wine; take international advanced level as benchmarking, confirmedly promote high quality strategy, improve internal quality and external appearance of products in order to achieve the comprehensive transcendence to major competitive products. The Company will centralize resources to make several big products at different levels, through which the Company could promote the continuous improvement of the Company’s brand awareness and influence.

Secondly, the Company will reform sales system to build new sales system that could adapt to development requirement. The Company will further perfect the relatively-independent sales system construction of wine, brandy and imported liquor to promote comprehensive development of various liquor; through downsizing staff and improving efficiency, perfecting salary system and other measures, increase the salary of sales personnel, improve their work enthusiasm and stimulate the market vitality; strengthen system construction of backbone distributor, build unified customer complaint system facing distributors and customers, improve their internal motivation in selling Changyu products; focus on brand image of “Internationalization, High Quality”, actively develop the export business and improve brand influence.

Thirdly, the Company will carry out order mode and promote informatization system construction for production and sales plan. The Company will accelerate the informatization system construction, roundly promote order-driven mode, build the company into a smart factory, significantly improve the market service capacity of production system, reduce the inventory scale and fund occupation, thoroughly sole the problem of disconnection between production and sales.

Fourthly, the Company will strengthen finance governance to perfect evaluation system whose principal line is profit. The Company will establish the assessment system taking profit as main line to improve profitability; strengthen profit assessment in self-supporting grape base, perfect the budget management of various expense and control operating cost; optimize the Company’s analysis system of consolidated statement and financial assessment to improve supervision efficiency of financial assessment; continue reinforcing the management of major expense and consumption level; actively strive for project loan and policy-based fund loan to reduce loan cost; reinforce tax planning and reduce tax bearing level.

Fifthly, the Company will reinforce supervision and administration function to improve management level of overseas acquired enterprise. The Company will faithfully strengthen operation management of overseas asset to assure the healthy operation of overseas acquired enterprise; improve the positivity of overseas management team and build overseas acquired enterprise to be “International Marketing Platform”, “Grape Resource Platform” and “Technology Communication Platform” through series measures, such as reinforcing the third-party audit and perfecting enthusiasm policy and so on.

Sixthly, the Company will reasonably delegate power to lower levels and reinforce monitoring simultaneously to improve enthusiasm of subsidiaries. Meanwhile the Company delegates more autonomy in management to subsidiaries, the C will also reinforce supervision to ensure that the subsidiaries could maintain right development direction and operation trajectory.

Seventhly, the Company will steadily promote the construction of investment projects to assure the project quality. The Company will accelerate to complete the commissioning work of production lines in research and development center, improve production stability and give full play to high efficiency of production lines; accelerate to promote putting Tinlot chateau and Koya chateau into operation; complete the construction of second-phase SAP project in Changyu industrial park (Yantai Changyu international wine city).

(2) Whether major business has significant changes during the report period?

□Yes RNo

(3) The condition of products accounting for over 10% in the Company’s main operating incomes or main operating profits

RAvailable □Not available

Unit: CNY

|

|

Operating income |

Operating cost |

Gross profit rate |

Year-on-year increase or decrease (%) of operating income |

Year-on-year increase or decrease (%) of operating cost |

Year-on-year increase or decrease (%) of gross profit rate |

|

Wine |

3,829,326,556 |

1,266,391,452 |

66.93% |

3.47% |

5.11% |

-0.52% |

|

Brandy |

989,889,728 |

352,328,968 |

64.41% |

9.30% |

10.85% |

-0.50% |

(4) Whether there are features of operating seasonality or periodicity required special attention

□Yes RNo

(5) Explanation for the operating income, operating cost, total net profit attributed to the common shareholders of the listed company or constituting major changes compared with former report period

□Available RNot available

(6) Face of suspension and termination of listing

□Available RNot available

(7) Related items involving financial report

①Explanation for the changes of the accounting policy, accounting estimation and accounting method

RAvailable □Not available

In accordance with related regulation of Ministry of Finance, the Company plans to change the accounting policy about “Government Grants”. Detailed information are shown as follows:

Before the change: The

Company executes 《Accounting Standard for

Business Enterprises No. 16 - Government Grants》involved in《Notification of Ministry of Finance on Printing and Distributing 38 Items

of Specific Standards Including

After the change: The Company executes《Accounting Standard for Business Enterprises No. 16 - Government Grants》(Cai Kuai [2017] No.15) formulated by Ministry of Finance. For the rest unchanged parts, the Company will still execute relevant standards and regulations published by Ministry of Finance on February 15th, 2006. Hereby, the accounting treatment in government grants will be divided into three classes: firstly, loan interest subsidy offsets “Financial Expense”; secondly, it is classified into “Other Income”; thirdly, those that are not relevant with operating activity are classified into “Non-operating Income”.

②During the report period, the situation explanation for the correction of major accounting errors which need to be retrospect and restated

□Available RNot available

There is no situation for the correction of major accounting errors which need to be retrospect and restated.

③Compared with the previous year’s financial report, explanation for the changes of the consolidated statements scope.

RAvailable □Not available

①On May 11th, 2017, this company, together with LAMBO SpA signed Agreement among Shareholders and Price Adjustment Agreement, establishes a joint venture enterprise Indomita Wine Company Chile, SpA (Chinese name: 智利魔狮葡萄酒简式股份公司, for short “Indomita Wine”) with an investment of USD4,190,000. This Company offers USD40,110,000, holding 85% equity of Indomita Wine. After establishment, as transferee, Indomita Wine offers USD47,190,000, acquiring 100% equity of all three subsidiaries under Chile Bethwines. On July 1st, 2017, this Company completed all the prerequisites regarding share purchase, obtaining the control of three subsidiaries under Chile Bethwines. During the report period, Indomita Wine and its subsidiaries all are included in the consolidate scope.

②On January 18th, 2017, this company newly establishes Sales & Marketing Company of Yantai Changyu Pioneer Wine Company Limited with the registered capital of CNY5million and the business scope of wholesale business and retail business. This newly established company is included in the consolidate scope during the report period.

Yantai Changyu Pioneer Wine Co. Ltd.

Board of Directors

April 23rd,N 2018